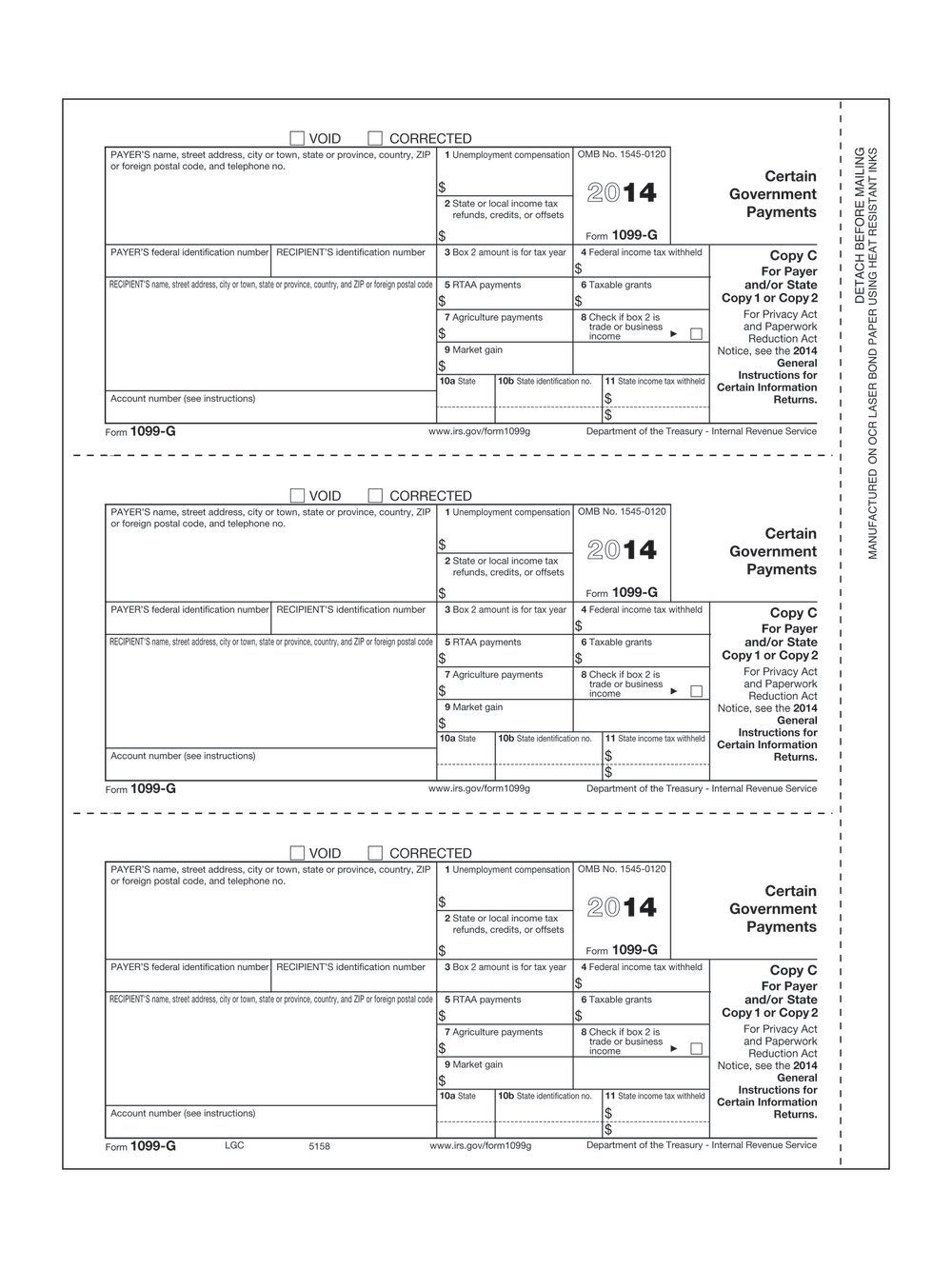

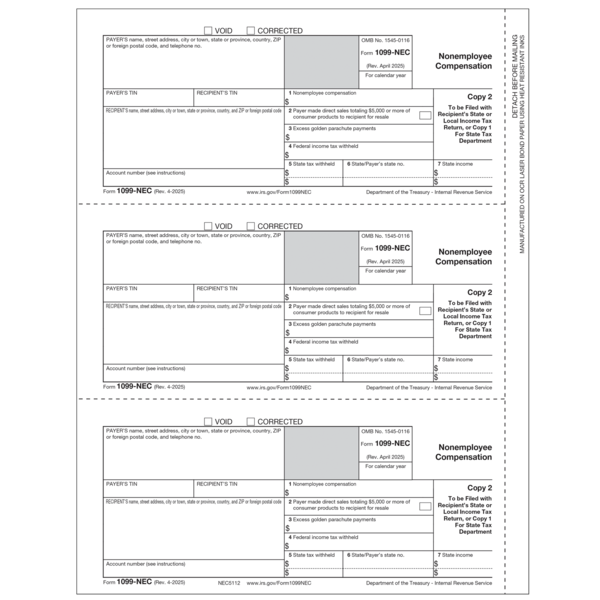

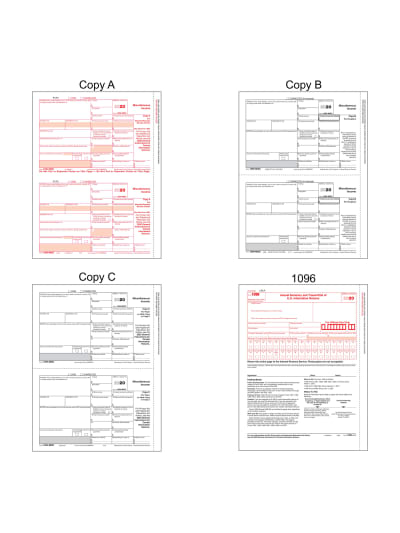

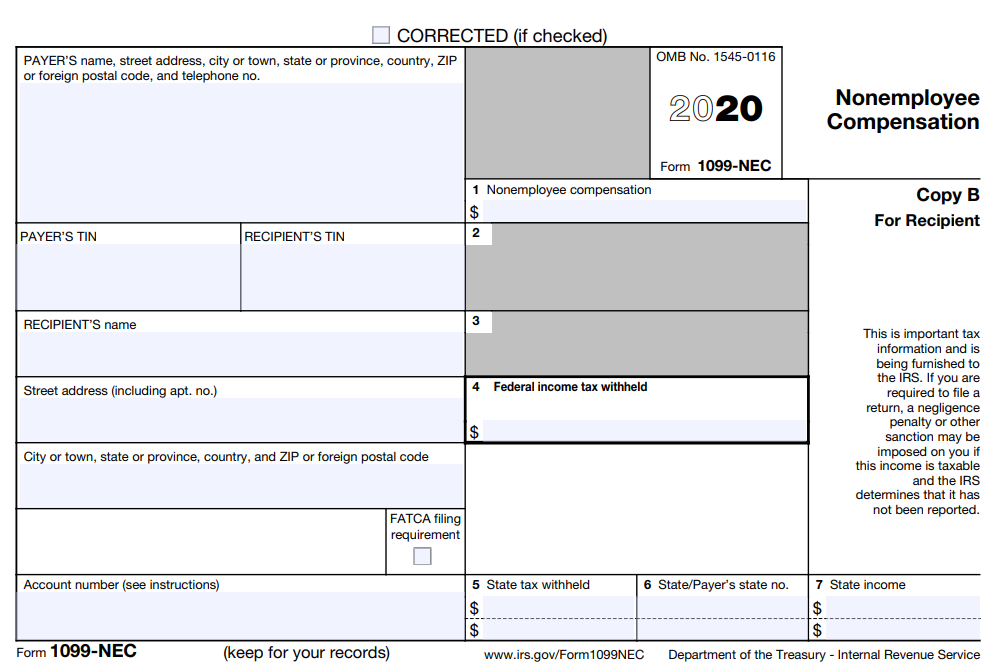

There are three copies of Form 1099NEC Copy A To be completed and sent to IRS; If you file a physical copy of Form 1099NEC, Copy A to the IRS, you also need to complete and file Form 1096 The IRS uses Form 1096 to track every physical 1099 you are filing for the year The deadline for Form 1096 is 5 Check if you need to submit 1099 forms with your stateCopy C goes to the payer or filing agency You may need to report some of the information from Form 1099G on your income tax return, but you don't need to submit a copy

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 nec copy c goes to

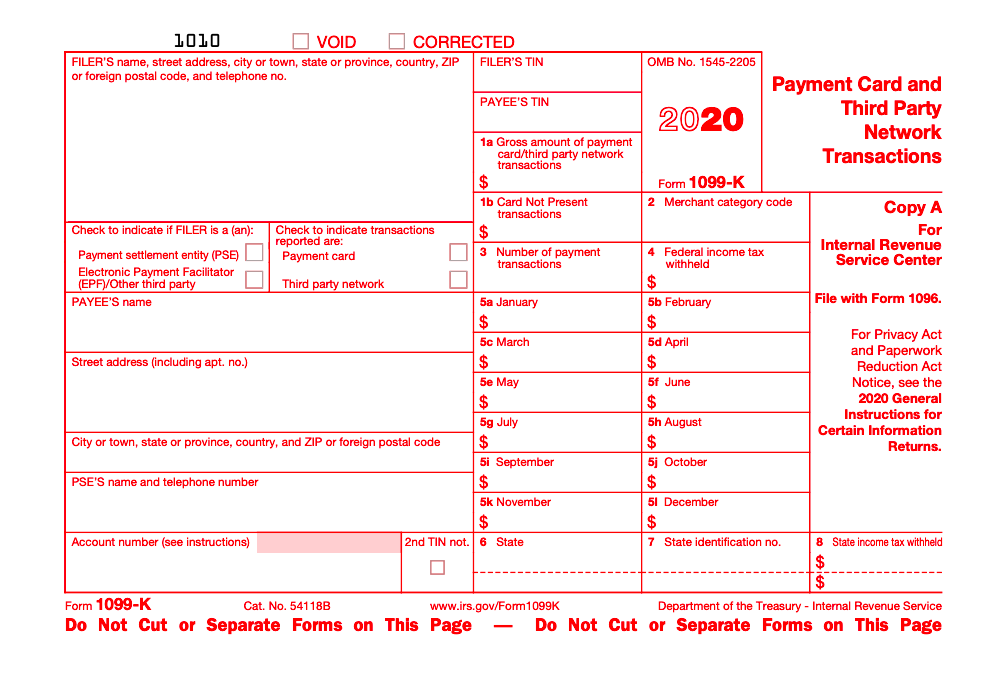

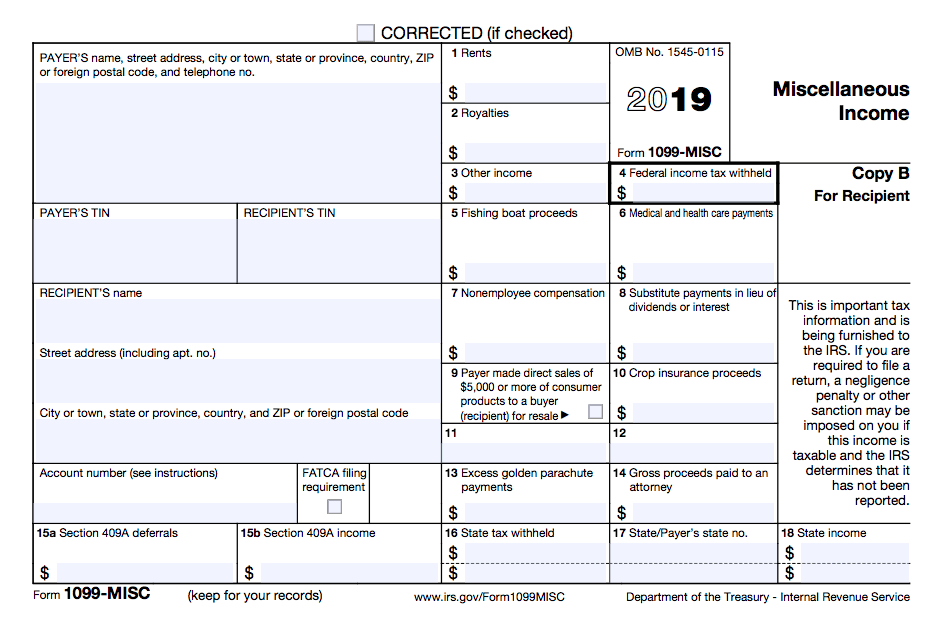

1099 nec copy c goes to-When filing federal copies of forms 1099 with the IRS from the state of Form 1099NEC Report payments for rents, royalties, prizes, medical/healthcare payments, backup withholding, and other Report payments to nonemployees, including independent contractors, small businesses, attorneys, and individuals Due date February 28 of the year after the tax year

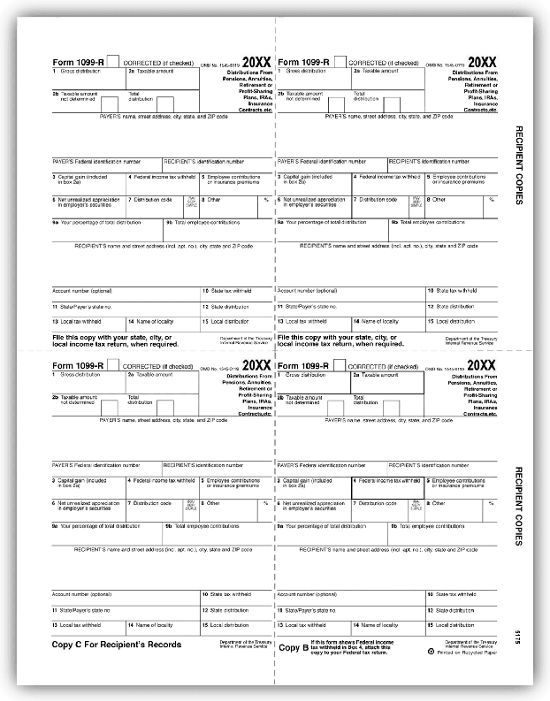

1099 R Recipient Federal Copy B

If you are issuing 1099 forms, copy A goes to the IRS, you keep copy C, and the rest of them go to the person that you paid If you are receiving forms 1099, the various copies are for your federal, state, and local filings Generally, you are not required to submit the forms with your return even though you have multiple copies email protectedReporting threshold If you file 250 or more 1099 forms with Colorado you must file electronically;All 1099 forms must be submitted to the IRS and the recipient, but some forms must also be submitted to the Department of Revenue for certain states With the new 1099NEC and 1099MISC, many states' requirements are in flux Starting with tax year , Track1099 will offer a 1099 state efiling service to certain states

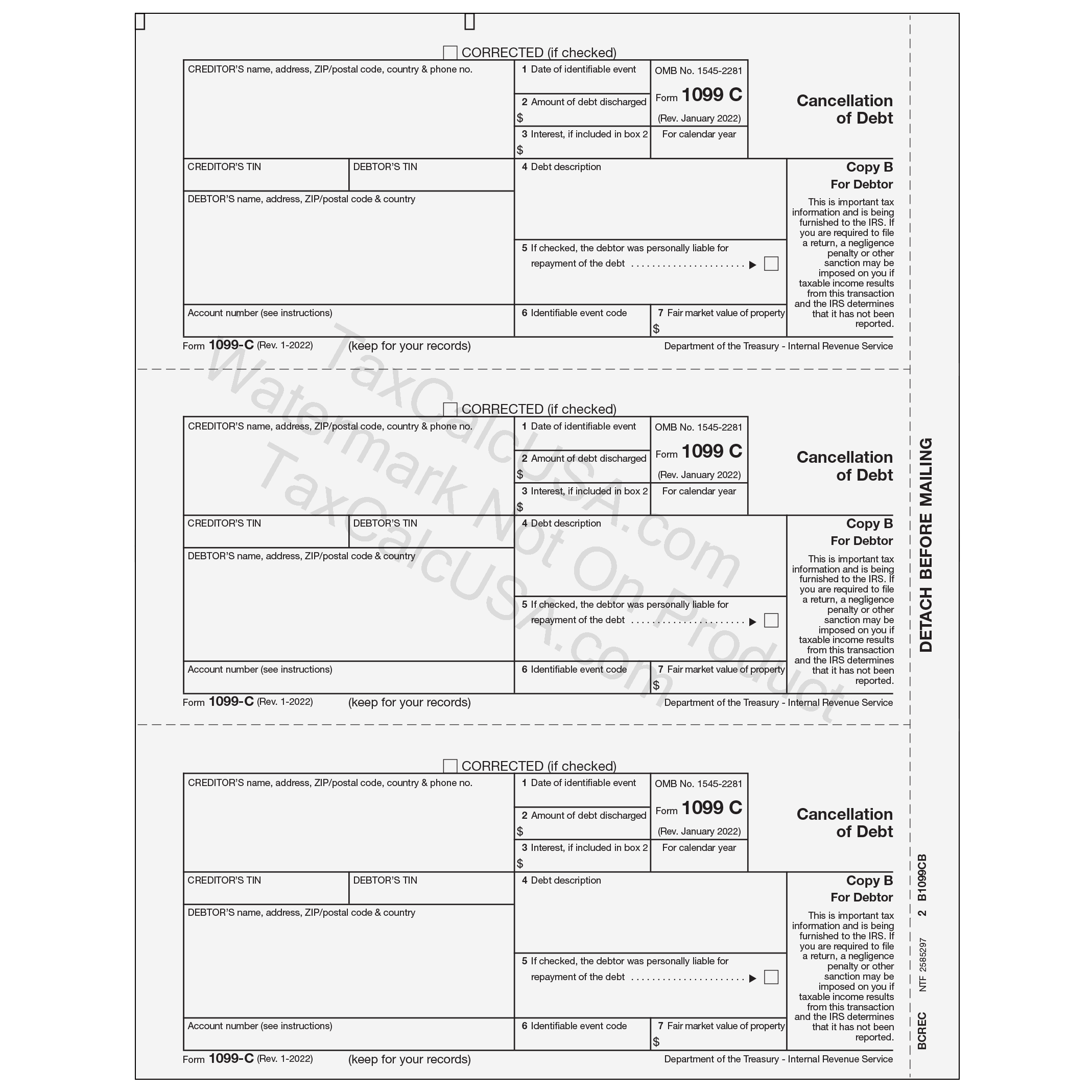

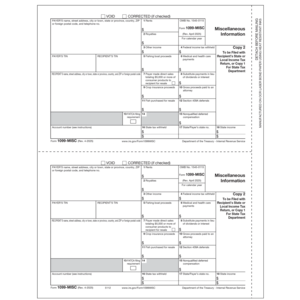

Form 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses the form to Step by Step Instructions for filing Form 1099NEC for tax year Updated on 1030 AM by Admin, ExpressEfile Form 1099NEC, it isn't a replacement of Form 1099MISC, it only replaces the use of Form 1099MISC for reporting the Nonemployee Compensation paid to independent contractors Copy A goes to the IRS If your state has income tax, you will also need to send Copy 1 to the appropriate state tax department Copy B goes to the independent contractor, and you may also need to send them Copy 2 so that they can file it along with their other state income tax materials Copy C is for your records

Mail form 1096 and Copy A of each 1099 form to the IRS Maryland taxpayers must mail copies to Department of Treasury Internal Revenue Service Center Kansas City, MO Step 5 Give or mail Copy 1, Copy 2 and Copy B to the subcontractor listed on the respective 1099 form Keep Copy C for your records The 1099 correction form is the same as the original form You must use a regular copy of Form 1099 (either NEC or MISC) and mark the box next to "CORRECTED" at the top Send corrected Forms 1099 to the IRS, contractor or vendor, and state agencies (if applicable) Click Here to Create Your Form 1099Misc in Less Than 2 Minutes Step 3 Fill Out the Forms These forms are printed in triplicate You will send Copy A to the IRS Copy B goes to the independent contractors, and Copy C is yours to keep for your records You'll start with your information This could be your social security number if you're a

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

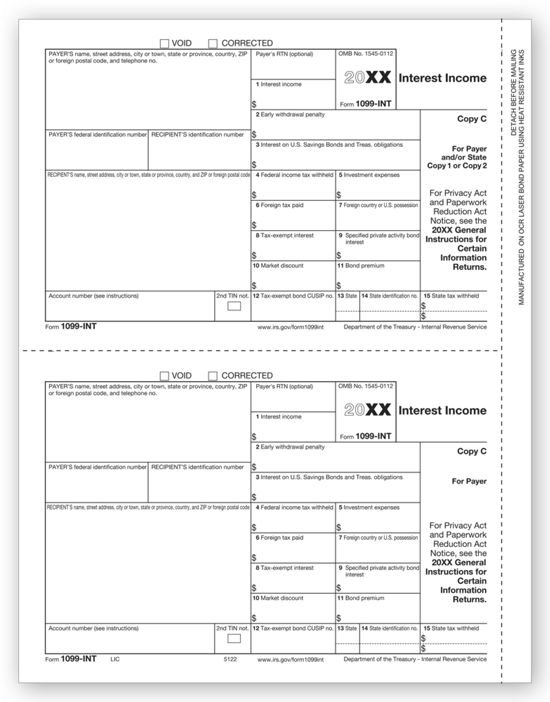

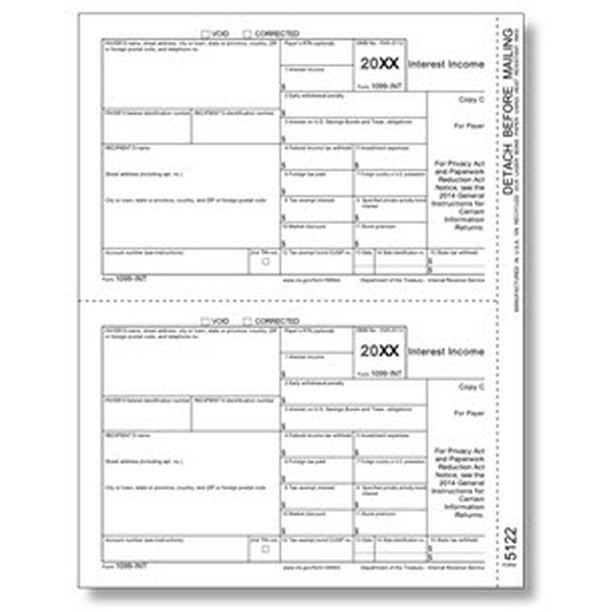

1099 Int Payer Copy C Or State

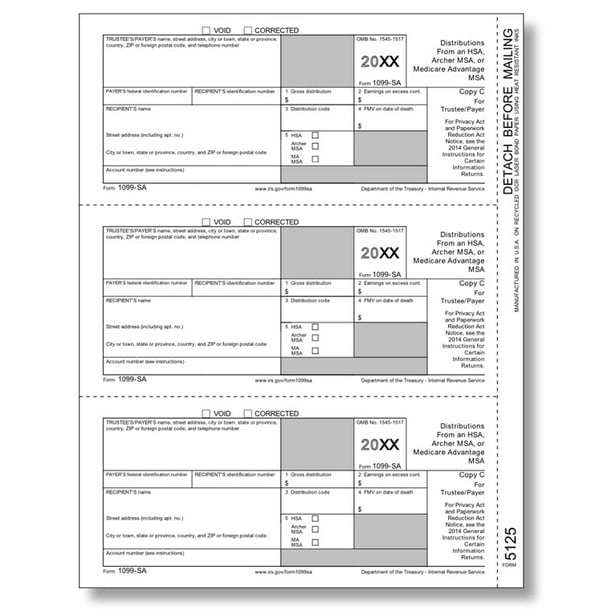

Receiving a 1099C should always mean the debt is canceled and no longer subject to collection But it may be up to you to make sure Until 16, IRS rules allowed creditors to file a 1099C if no payments had been made on a debt for 36 months This resulted in many 1099C forms being issued for debts that were delinquent but not actually forgiven These 1099 forms might require you to submit Copy 1 to the State tax department If you have a cancellation of your debt, you might need to file Copy 1 of your 1099C with your State tax department This cancelled debt might be taxable income The 1099G is used by governmental agencies to report their State income tax refunds and unemploymentGenerally, you are not required to submit the forms with your return

21 Laser 1099 Int Income State Copy C Deluxe Com

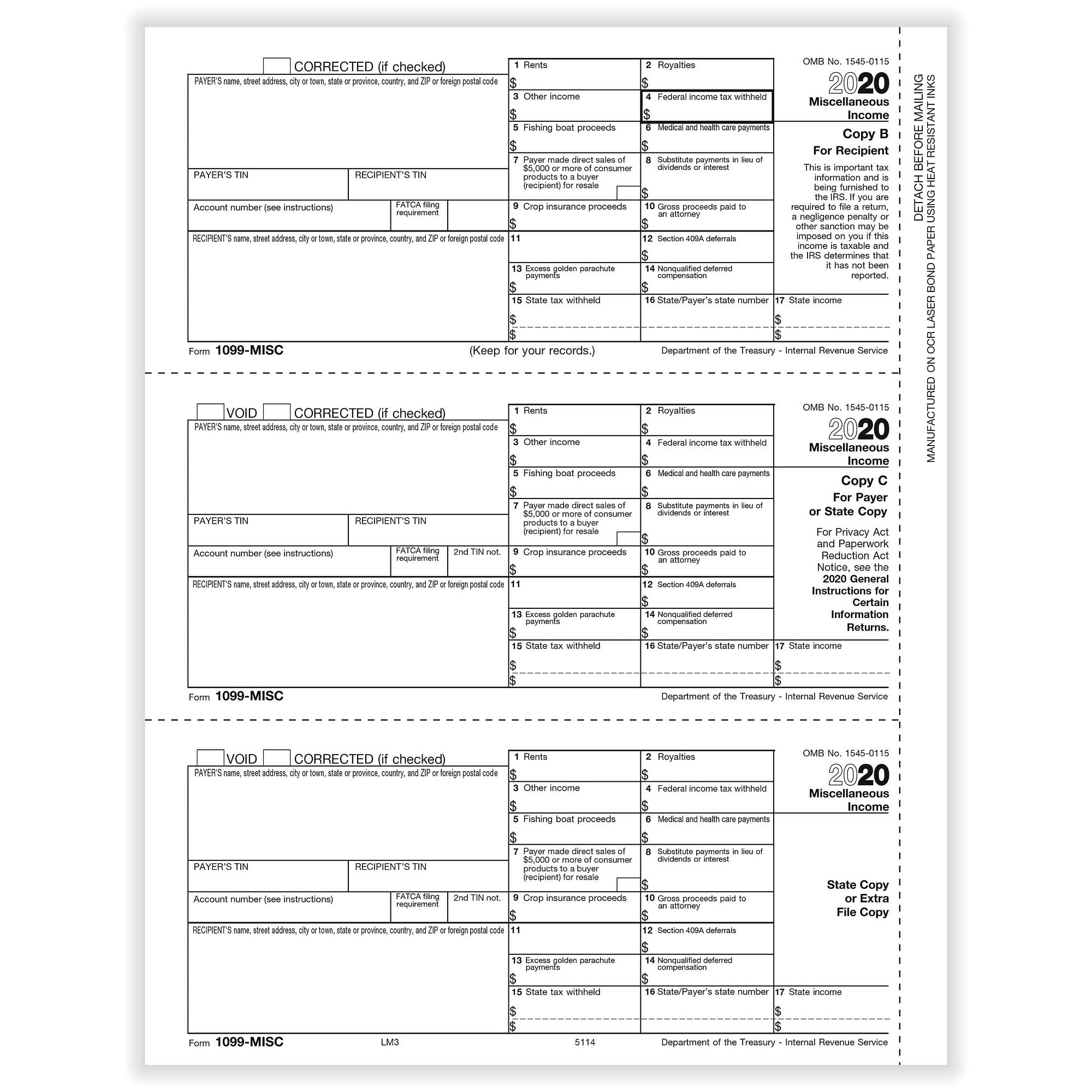

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

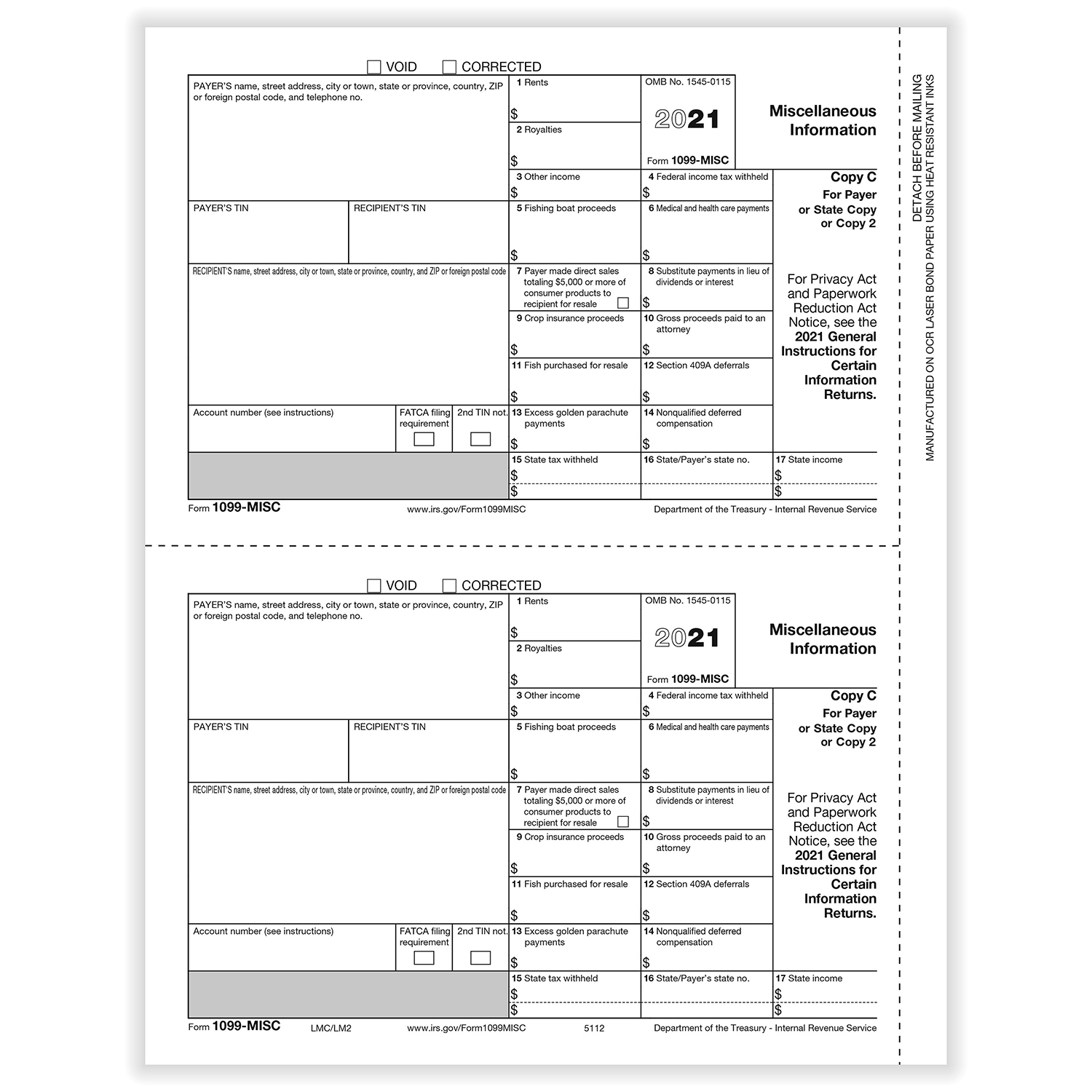

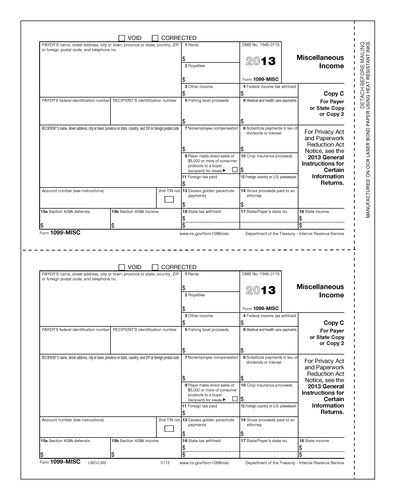

There are five separate copies of Form 1099MISC, one of which is for IRS use only Here's a breakdown Copy A goes to the IRS Copy 1 goes to the recipient's state tax department Copy B is kept by the recipient Copy 2 goes along with the taxpayer's state tax return Copy C is kept by the taxpayerIf you are receiving forms 1099, the various copies are for your federal, state, and local filings;Forms are 8 ½" x 11" with no side perforation and printed on # laser paper Order the quantity equal to the number of employees for which you need to file 1099MISC Miscellaneous Income (Who gets what copy) Copy A For Payer to file with IRS Copy B For Recipient to keep for their files/records Copy C/State/2 Copy C For Payer or State Copy or Copy 2

1099 1098 5498 3 Up Blank Form Without Instructions Forms Fulfillment

1099 C Debtor Copy B For 50 Recipients Office Products Tax Forms Eudirect78 Eu

Specific Instructions for Form 1099C The creditor's phone number must be provided in the creditor's information box It should be a central number for all canceled debts at which a person may be reached who will ensure the debtor is connected with the correct department Do not file Form 1099C when fraudulent debt is canceled due to identity theft Form 1099C is to be used The 1099MISC has Copy A, B, C, 1 and 2 Copy A is sent to the IRS along with the 1096 Copy B is sent to the recipient and the recipient keeps that copy The payer or the business issues the 1099MISC forms to vendors/contractors should retain Copy CCopy C—Stays with the employer for record keeping Technically, copies 1, 2, B, and C can be printed at home Copy A, which goes to the IRS, must be printed on a special red version of the form These are widely available online, at office supply stores, and

Use Form 1099 Nec To Report Non Employee Compensation In

1099 C Form Copy C Creditor Discount Tax Forms

Copy B To be sent to recipient/contractor either by postal mail or email;You may request a 30day extension for filing Forms 1099MISC, 1099NEC, and 1099R with the department, but the due date for furnishing a copy of the information return to the recipient cannot be extendedIRS Form W9 Request for Taxpayer Identification Number allows you to formally gather the 1099 vendor's information

1099 Int Forms For Intacct

21 4 Up Laser 1099 R Recipient Copy B C 2 Bulk Deluxe Com

1 What is a 1099C? NEC stands for "nonemployee compensation," and Form 1099NEC includes information on payments you made during the previous calendar year to nonemployees You must send a 1099NEC form to any nonemployees to whom you paid $600 or more during the year This form is NOT used for employee wages and salariesIf you are issuing 1099 forms, copy A goes to the IRS, you keep copy C, and the rest of them go to the person that you paid;

Www Irs Gov Pub Irs Pdf I1099msc Pdf

Office Depot

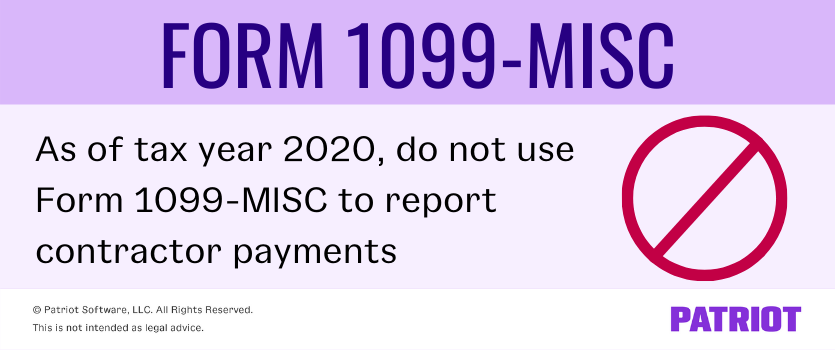

You likely need a different 1099 form this year If you have used 1099MISC form to report payments to contractors, freelancers or for any type of nonemployee compensation in Box 7, you MUST USE THE NEW 1099NEC form in Order 1099NEC Copy C A 1099C is a tax form that the IRS requires lenders use to report "cancellation of indebtedness income" This form must be filed in certain circumstances where more than $600 in debt is cancelled, or goes unpaid for a certain period of time The lender files this form with the IRS and a copy is supposed to be sent to the taxpayer as wellThrough the CF/SF Program, the IRS electronically forwards 1099 forms to participating states Some states require separate notification from the employer that they are filing 1099 forms through the CF/SF Program The IRS acts as a forwarding agent only, so it is your responsibility to contact your state to verify that they have received the form and to find if they need additional

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

Didn T Receive A Form 1099 Don T Ask

Information, put and ask for legallybinding digital signatures Work from any gadget and share docs by email or fax Check out now?1099c copy b Reap the benefits of a digital solution to develop, edit and sign documents in PDF or Word format on the web Convert them into templates for numerous use, insert fillable fields to collect recipients?For instant ticket sales, State X pays commissions by providing tickets to the agent for 5% less than the proceeds to be obtained by the agent from the sale of those tickets If the commissions for the year total $600 or more, they must be reported in box 1 of Form 1099NEC See Rev Rul 9296, CB 281

Amazon Com Laser 1099 Div Tax Form Copy C 100 Forms 2 Forms Per Sheet Office Products

Tf5122 Laser 1099 Int Interest Income State Copy C 8 1 2 X 11

Form 1099R Distribution Codes for Defined Contribution Plans Form 1099R must be sent no later than January 31 following the calendar year of the distribution The image below highlights the 1099R boxes most frequently used—and their explanations—for defined contribution plan distributions The following chart provides the distribution Copy 1 is for the state tax department and Copy 2 is for submission with the recipient's state income taxes, where applicable Copy C, on the other hand, is the employer's to keep on file Make sure you keep a copy of every 1099 you file each year in the event your business is ever audited by the IRS Advertisement This is because you need to send your contractor a copy of the 1099NEC The contractor will file their copy on their tax return You will need to file yours on your tax return So, these two forms need to be completed 1099NEC, Copy C — Lists Income You Paid to Contractor – File on your return

1099misc Filing Forms Software E File Zbpforms Com

1099 Misc Income Form 1099 Form Copy C 1099 Form Formstax

File the following forms with the state of Colorado 1099MISC / 1099NEC and 1099R Filing due dates File the state copy of form 1099 with the Colorado taxation agency by ; TurboTax does not have actual copies of your 1099C But if you typed in or imported those documents, your program will have worksheets that contain all the info on the original document In the forms mode (in desktop/cd versions of TurboTax), scroll down the forms list and look for 1099C worksheets (with the name of the issuing company)Know the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keeping W2 1099 Forms Filer Pricing

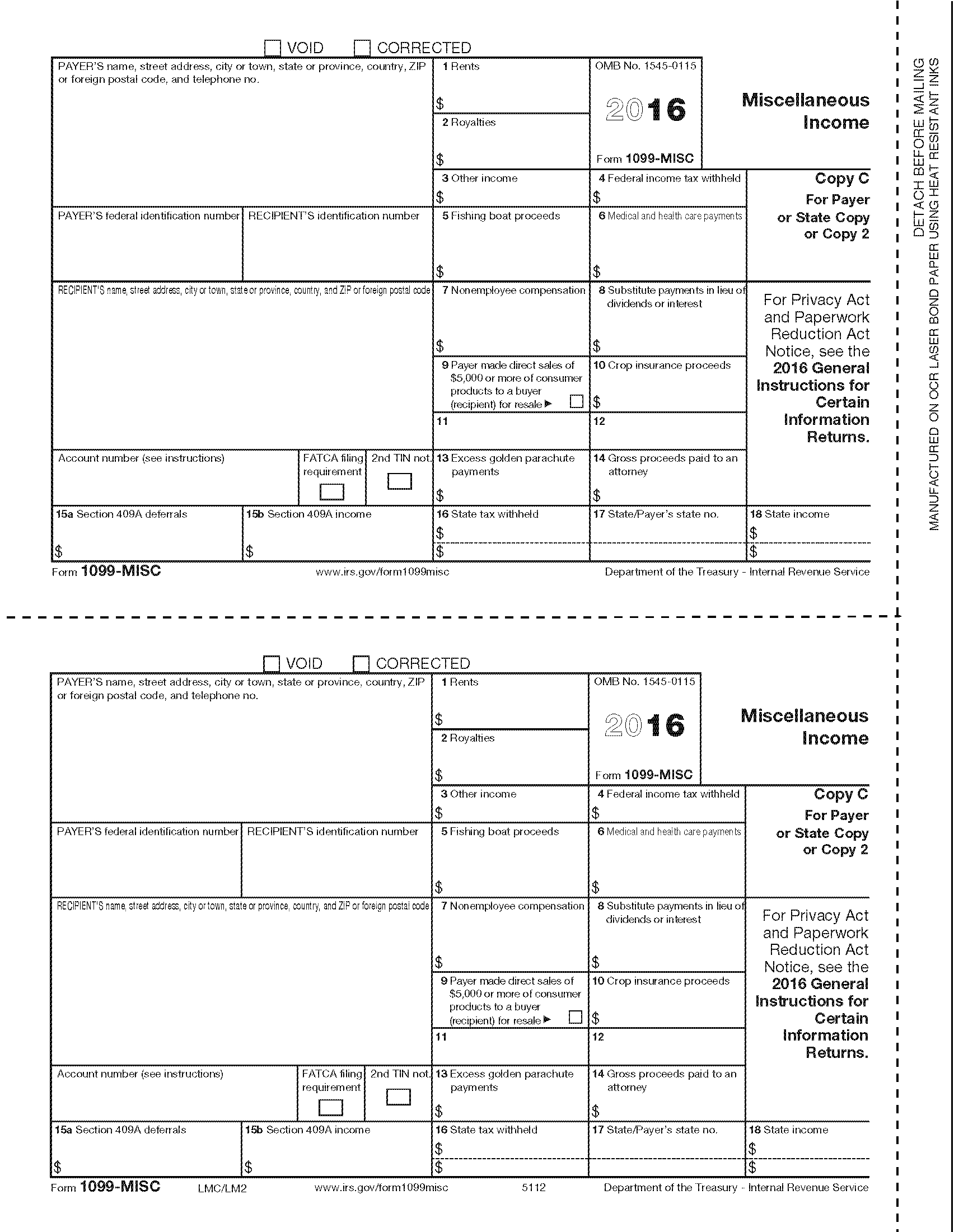

Tf5112 Laser 1099 Miscellaneous Income Payer State Copy C 8 1 2 X 11

Tax Form 1099 Int Copy C 1 Payer 5122 Form Center

Here's the next form in the set It's called Copy B and goes to the 1099 vendor These also print 2 vendors per page and you should separate the forms and mail to the vendor along with Copy 2 in the same envelopeAre extensions available if I can't file information returns (Forms 1099MISC, 1099NEC, and 1099R) by the due date?The Copy A must be filed with the IRS The deadline to file this return for the current tax year is

1099 R Recipient Federal Copy B

Common 1099 Processing Questions

A 1099C reports Cancellation of Debt Income (CODI) A lender is supposed to file a 1099C form if it "cancels" $600 or more in debt It files a copyCopy C This is a paper copy;If you made certain payments to an employee or other recipient during the Tax Year, you may need file a Form 1099 to the IRS and send a copy to the payment's recipient Additionally, you will need to file a Form 1096, which is used to transmit your paper Form 1099 See the sections below for information on issuing Form 1099 (or 1096)

1099 Nec Form Copy B C 2 3up Zbp Forms

1099 C Form Copy A Federal Discount Tax Forms

Note These questions are intended to help you prepare your individual income tax return if you received a Form 1099G because a state or local tax refund was reported to the Internal Revenue Service (IRS) or a Form 1099INT was reported to the IRS 1099c If you had more than $600 worth of debt canceled, the creditor will typically file this form with the IRS, and you will receive a copy You may have a Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Irs Approved 1099 C Copy C Laser Tax Prep Form 100 Forms

Your 1099MISC forms will be distributed as follows Copy A files with IRS Copy 1 file with the State Tax Department Copy B goes to the recipient Copy 2 goes to the recipient for State filing Copy C is for the payer Hopefully, that clears it up for you Copy B and Copy 2 go to the recipient for filing Starting in 21, send copies of Form 1099NEC to workers you paid nonemployee compensation to during the year by January 31 or the next business day (if it falls on a weekend) Also file Copy A with the IRS by January 31 each year Looking for a way to track nonemployee compensation and other 1099 payments that doesn't make your head spin?Official 1099MISC Forms The IRS has combined Copy C and Copy 2 to one page Print 2 forms for a single employee on one sheet STOP!

Amazon Com Egp Irs Approved 1099 S Laser Tax Form Recipient Copy B Quantity 100 Recipients Accounting Forms Office Products

1099 Misc Payer Copy C

For example, if you have three 1099 vendors, you would send the red Copy A of each 1099NEC to the IRS along with one summary 1096 Copy B goes to the Vendor You keep Copy C How Do I Collect Information for 1099 Vendors?Copy B is for the recipient's records and informs the recipient of the amount you're reporting to the IRS When required, the recipient files Copy 2 with the state income tax return Print Copies C and 1 for yourself Copy C is for your records Copy 1 is for you to file with your state when requiredThe business who hired a contractor files the form 1099NEC For every form there are two copies with the same information One copy goes to the IRS and the other copy goes to the contractor If you are the contractor receiving a copy of the 1099NEC, all of your NEC income goes on a schedule C when you file your taxes for that year

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Tax Form 1099 R Copy C 2 Recipient 5142 Mines Press

The deadline for a 1099MISC (with an amount in box 7) is January 31st, and is the deadline for both efiling and paperfiling Even if you missed the deadline, you should still be able to efile it 0 1,332 Reply You put the Copy A pages in the printer first and click on the Print 1099NEC button Then you put the Copy B pages in the printer and click on the Print 1099NEC button again Lastly, you put in the Copy C pages in the printer and click on the Print 1099NEC button again

1099 A Form Copy C Filer Or State Discount Tax Forms

Freelancers Meet The New Form 1099 Nec

Form 1099 Misc To Report Miscellaneous Income

Instant Form 1099 Generator Create 1099 Easily Form Pros

Form 1099 Misc Bhcb Pc

1099 Misc Form 5112 Copy C Pkg Of 100 Forms

Form 1099 Misc Miscellaneous Income Payer Copy C

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

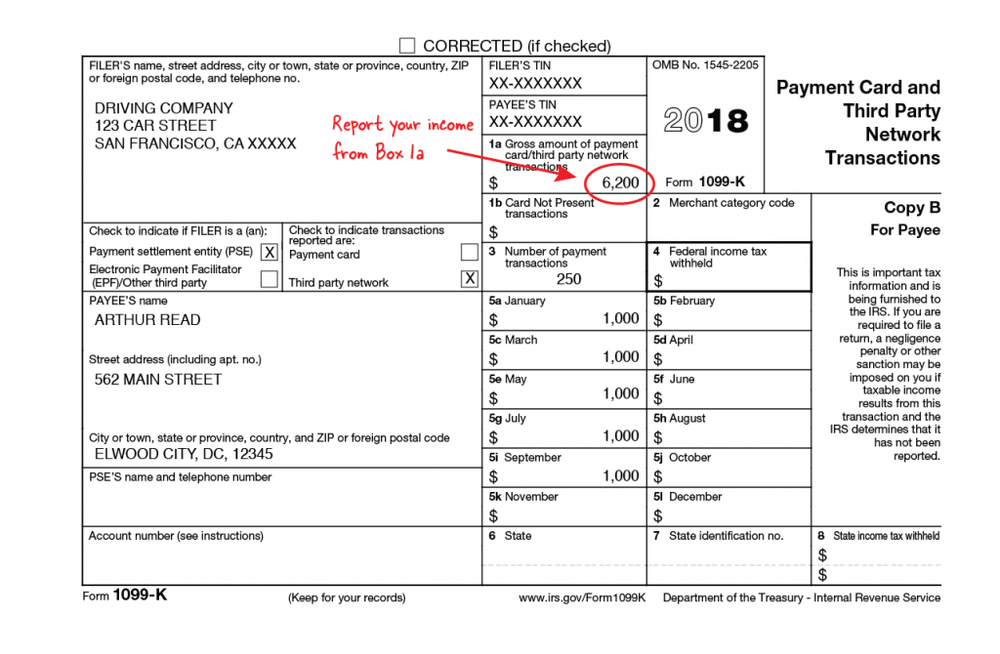

What Is A 1099 K Stride Blog

1099 Misc Form Fillable Printable Download Free Instructions

Verticalive Forms

1099 Tax Misc Form 1099 Misc Form 19 File 1099 Misc Form

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

Buy 21 1099 Misc Income Set 4 Part And 1096 Self Seal Envelopes Kit For 25 Vendors Online In Turkey B078j9hzv6

5112

1099 C Debtor Copy B For 50 Recipients Office Products Tax Forms Eudirect78 Eu

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Div 2 Up Preprinted Laser Payer Forms Hrdirect

Brrec05 Form 1099 R Distributions From Pensions Etc Copy C Recipient Brokerforms Com

Nec5112b

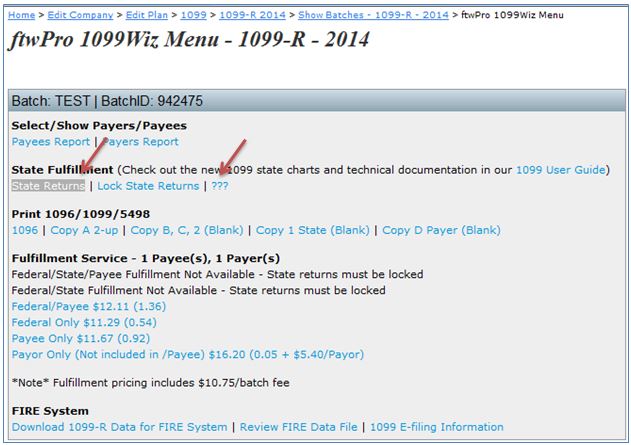

1099 Software User Guide Note This Is Intended To Be A General Guide To Introduce You To The Ftwilliam Com 1099 Software Features And Structure More Details Are Often Provided At Ftwilliam Com And Through Free Webinars Preformed Throughout The Year At

Office Depot

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

1099 Software User Guide

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Int Form Copy C Payer Zbp Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Nec Form Copy C 2 Zbp Forms

1099 Form Fileunemployment Org

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

Bmis105 1099 Misc Miscellaneous Information Payer State Copy 1 Greatland Com

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Misc To Report Miscellaneous Income

1099 Misc Forms 4 Part 18 Laser Tax Forms For 25 Vendors Pack Of Federal Copy A Recipient Copy B State Payer Copy C 1096 Transmittal Sheets Irs Compliant Buy

Amazon Com Irs Approved 1099 Oid State Copy C Tax Form 100 Recipients Office Products

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Form 1099 K Everything You Need To Know Bench Accounting

1

1099 Misc Miscellaneous Income Payer Copy C 2up

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

1099 Misc Form Fillable Printable Download Free Instructions

1

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

1099 Misc Payer State Copy 1

Cmis054 Form 1099 Misc Miscellaneous Information 4 Part Set Carbonless Greatland Com

What Is 1099 Misc Form How To File It Complete Guide

1099 Nec Form Copy C 2 Payer Discount Tax Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

Irs Form 1099 Reporting For Small Business Owners In

1099 Misc Form 5 Part Carbonless Discount Tax Forms

Form 1099 Misc Miscellaneous Income Payer State Copy C

1099 R Form Copy C Recipient Zbp Forms

How To Fill Out 1099 Misc Irs Red Forms

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

1099 G Form Copy C State Discount Tax Forms

Tax Forms W2 1099 1040 Envelopes And More Staples

Irs Approved 1099 Sa Laser Copy C Tax Form Walmart Com Walmart Com

1099 Misc Forms Set Zbp Forms

Irs Approved 1099 Int Laser Payer Copy C Walmart Com Walmart Com

1099 Laser Misc Payer Copy C Item 5112

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 Misc 3up Combined Format Laser W 2taxforms Com

1

Form 1099 Nec Instructions And Tax Reporting Guide

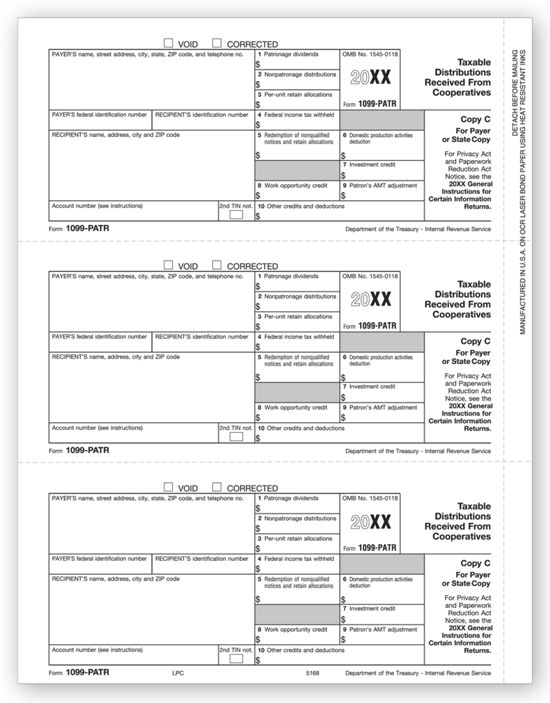

21 Laser 1099 Patr State Copy C Deluxe Com

Tf5112b 2 Up 1099 Misc Laser Payer State Copy C Tax Forms In Bulk Packs

Nec5112 2 Up 1099 Nec Laser Payer State Copy C Tax Form With Nec Non Employee Compensation New Form

Amazon Com Egp 1099 Misc Payer Or State Copy C Irs Approved Laser Quantity 3000 Forms Recipients 1500 Sheets 3 Cartons Office Products

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

0 件のコメント:

コメントを投稿